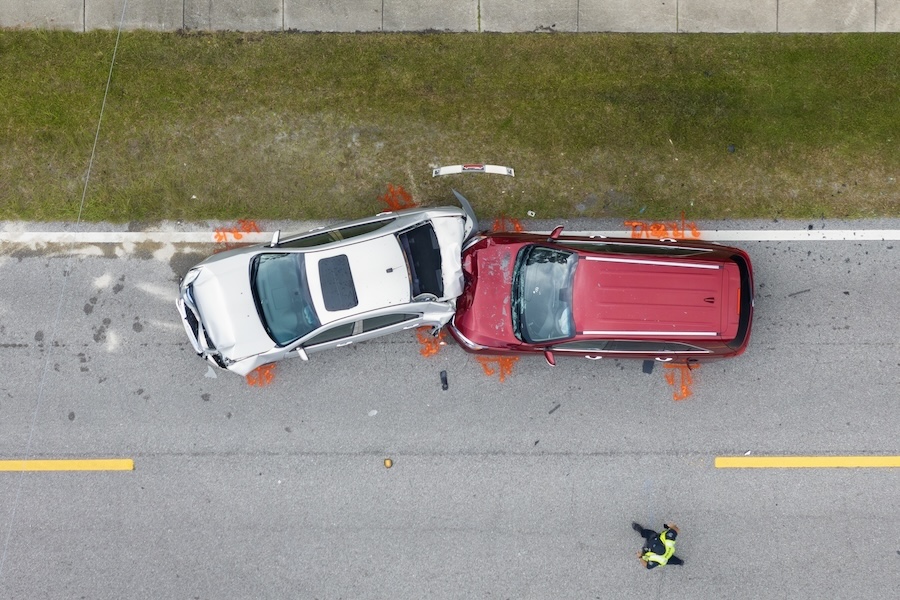

Planning a holiday road trip? Whether it’s a family drive across Texas or a longer journey, it’s smart to check your insurance coverages ahead of time. A breakdown, accident, or unexpected costs (rental, towing) can ruin the trip — or worse. Before you leave, make sure your policy protects you.

In this guide, we’ll walk through a pre-trip auto insurance checklist of coverages you should review now:

● UM / UIM (Uninsured / Underinsured Motorist)

● PIP / MedPay (where applicable)

● Rental car coverage

● Towing & labor/loss-of-use

● Additional coverages & tips

If you’re involved in a car accident, our Dallas car accidents practice can help you understand your claim and coverage options. You can always reach us at Wolf Law, PLLC — https://wolflawpllc.com/.

Why You Must Check Before You Drive

During the holidays, traffic, bad weather, and long hours increase risk. A policy that worked fine for short local drives may leave gaps during a cross-state holiday trip. Confirming your coverages ahead of time ensures you aren’t stuck paying out of pocket.

UM / UIM (Uninsured / Underinsured Motorist Coverage)

One of the most critical coverages to have for any drive — especially long ones — is UM/UIM.

● In Texas, insurance companies must offer you uninsured / underinsured motorist coverage, though you’re allowed to reject it in writing.

● That coverage helps you when the at-fault driver has no insurance or not enough to cover your losses.

● Benefits may include payment for your injuries, medical bills, car repairs, rental car, and even pain & suffering (depending on policy).

Pre-trip checklist item:

Make sure you did not reject it in writing. If you opted out, you may have no recourse when hit by an uninsured or underinsured driver.

Also check your limits (higher is better) to ensure they won’t be exhausted in a serious accident.

PIP / MedPay (Medical Payments Coverage)

In many states, Personal Injury Protection (PIP) or MedPay helps pay medical bills regardless of who’s at fault. Texas is not a full “no-fault” state, and PIP is not widely required, but some auto policies or endorsements may include medical payments or no-fault style coverages. (Note: Texas’s standard policy does not mandate PIP across all policies.)

Pre-trip checklist item:

Check whether your policy includes medical payments or PIP-like coverage, and confirm what it covers (injuries, hospital, ambulance, etc.). If you don’t have it, make sure you have good health insurance backup.

Rental Car Coverage / Loss-of-Use

If your vehicle is in the shop after an accident, you may need a rental car. Some auto policies include rental car or “loss-of-use” coverage; others require an add-on.

Pre-trip checklist item:

Verify whether your policy covers rentals, and under what conditions (daily limits, duration). If your policy doesn’t include it, consider adding that endorsement or arranging alternate coverage.

Towing, Labor, and Roadside Assistance

Breakdowns or minor collisions may not involve other drivers, but they still happen. Many policies offer towing & labor (roadside assistance) coverage.

Pre-trip checklist item:

Check whether your policy includes towing/labor (e.g., up to a certain mileage or dollar limit). Also verify whether fuel delivery, tire changes, battery jump starts, or locksmith services are covered. If it’s not included, you may want to purchase a separate roadside assistance plan.

Bonus Coverages & Tips

● Comprehensive / collision: Make sure your vehicle’s physical damage coverages (collision, comprehensive) are active and have an appropriate deductible.

● Glass / windshield: Some policies offer full glass repair with no deductible — useful during long drives.

● Gap insurance: If your car is recently leased or financed, gap coverage helps bridge difference if totaled.

● Check your declaration page & proof of insurance: Always carry proof of coverage (hard copy & digital).

● Trip-specific endorsements: Some insurers allow short-term endorsements (e.g. extended travel, cross-state permissions).

● Check for geographic restrictions: Some policies might restrict coverage in certain states or regions — make sure your route is fully covered.

Sample Pre-Trip Insurance Review Table (Quick View)

Here’s a quick summary you can go through before you hit the road:

| Coverage | What to Check | Why It Matters |

|---|---|---|

| UM / UIM | You didn’t reject it; limits | Covers costs when the other driver lacks or has insufficient insurance |

| PIP / MedPay | Whether included; what it pays | Helps with medical bills regardless of fault |

| Rental / Loss-of-Use | Whether it’s covered; how much | You get a ride while your car is repaired |

| Towing / Roadside | Whether towing & labor are included | Helps in breakdowns or roadside emergencies |

Why These Coverages Matter on Holiday Road Trips

During the holidays:

- More vehicles, bad weather, and unfamiliar roads increase accident risk

- You may be far from home with limited access to backup

- Other drivers may be stretched thin or in a hurry

- Big medical or repair bills can escalate quickly

Without adequate UM/UIM, PIP/MedPay, rental, towing, or physical damage coverage, you could end up paying tens of thousands out of pocket even if the accident wasn’t your fault.

Having the right coverages gives you peace of mind so you can focus on your trip.

What To Do If You Get in a Crash

If despite all preparation you get into an accident during your trip:

- Ensure safety – get off the road, check for injuries

- Call law enforcement & get an accident report

- Take photos & collect evidence (damage, scene, license plates)

- Notify your insurer ASAP, providing all the facts

- Check your UM/UIM, MedPay, towing, rental coverages and make formal claims

- Contact a qualified Texas car accident attorney to help you recover (including using UM/UIM or MedPay coverages)

If you need help understanding your coverage or managing your claim, Wolf Law, PLLC is ready to assist. Check out our Car Accidents practice page or reach out through our main site: https://wolflawpllc.com/